GigaCloud Technology Inc. (GCT) is among the stocks closely monitored by Maximvisitors recently. Therefore, it could be prudent to examine some elements that may influence the stock's short-term performance.

Over the last month, shares of this company have declined by 11.9%, compared to the Zacks S&P 500 Composite’s decrease of 7.7%. Given that GigaCloud Technology Inc. falls under the Zacks Technology Services sector, which has dropped by 7.8% during this timeframe, an important consideration now is where the stock might head in the short term.

Although media announcements or gossip regarding significant shifts in a firm’s business outlook often cause its stock to become trendy and result in instant pricing adjustments, underlying realities generally take precedence when it comes to making long-term purchase and retention choices.

Earnings Estimate Revisions

Instead of concentrating on other factors, Zacks emphasizes assessing the shift in a firm’s earnings forecast. We do this because we consider the true worth of its stock to be based on the current valuation of its anticipated future earnings stream.

Our assessment primarily hinges on tracking adjustments made by sell-side analysts who cover the stock, particularly regarding updates to their earnings forecasts in light of recent business developments. An increase in these forecasted earnings typically elevates the perceived intrinsic worth of the company’s shares. Consequently, should an equity's calculated inherent value exceed its present trading price, investor interest often surges, driving the share price upwards. For this reason, research shows a robust link between fluctuations in earnings estimate revisions and near-term shifts in stock prices.

In the present quarter, GigaCloud Technology Inc. is anticipated to report earnings of $0.46 per share, reflecting a decline of -45.2% compared to the same period last year. Over the past thirty days, the Zacks Consensus Estimate has not been adjusted.

The projected average earnings per share for this fiscal year stands at $2.90, reflecting a decrease of -4.9% compared to the previous year. Over the past thirty days, this forecast has been adjusted upwards by +0.4%.

For the upcoming fiscal year, analysts project an earning estimate of $3.51 per share for GigaCloud Technology Inc., marking a 21% increase compared to their forecast from last year. Throughout this past month, these estimates have not been adjusted.

With a robust externally verified performance history, our exclusive stock evaluation system, known as the Zacks Rank, provides a clearer view of a stock’s potential short-term price movement by capitalizing on the impact of revisions in earnings forecasts. Given the significant shift in the latest consensus estimate, coupled with three additional elements linked to earnings predictions, GigaCloud Technology Inc. has been assigned a Zacks Rank #3 (Hold) rating.

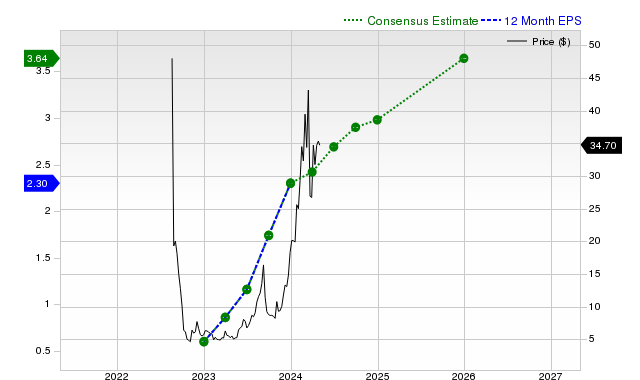

The table beneath illustrates the progression of the firm's projected 12-month average consensus earnings per share (EPS):

12 Month EPS

Revenue Growth Forecast

Although earnings growth is widely considered the best measure of a company’s fiscal well-being, this metric means little if the business fails to boost its sales. Essentially, sustaining higher profits over time becomes extremely difficult unless the company can also raise its revenue levels. Therefore, understanding a firm's prospective revenue expansion is crucial.

For GigaCloud Technology Inc., the projected sales estimate of $257.4 million for this quarter suggests a year-over-year increase of 2.5%. Additionally, forecasts predict revenues of $1.2 billion for the present fiscal year and $1.32 billion for the following one, representing respective yearly growths of 3.3% and 9.8%.

Previously Reported Outcomes and Unexpected Occurrences

In the most recent financial quarter, GigaCloud Technology Inc. announced revenues totaling $295.78 million, marking a 20.9% increase compared to the previous year. However, the earnings per share (EPS) stood at $0.76 for this period, down from $0.87 recorded in the corresponding timeframe last year.

In comparison to the Zacks Consensus Estimate of $290 million, the recorded revenues showed a positive surprise of 1.99%. However, the earnings per share (EPS) surprised negatively by 15.56%.

In the past four quarters, GigaCloud Technology Inc. exceeded the average earnings per share expectations set by analysts twice. During this same timeframe, the company also managed to outperform revenue forecasts every single quarter.

Valuation

Not taking into account a stock’s valuation makes it impossible to make an effective investment choice. When forecasting a stock's potential for future price gains, it's essential to assess if its present pricing accurately represents the inherent worth of the core business along with the firm's expansion opportunities.

When you compare a firm’s current valuation metrics like the price-to-earnings (P/E), price-to-sales (P/S), and price-to-cash flow (P/CF) ratios against their past figures, it can help ascertain if the stock is correctly priced, overpriced, or underpriced. On the other hand, evaluating these same indicators for similar companies provides insight into how reasonably priced the stock truly is within its industry context.

The Zacks Value Style Score (a component of the Zacks Style Scores system) focuses closely on both conventional and non-traditional valuation measures to rate stocks from A to F (with an A being superior to a B, and a B preferable to a C, etc.). This score is quite useful for determining if a stock might be overpriced, fairly priced, or momentarily underpriced.

GigaCloud Technology Inc. has received an A rating in this area, suggesting that it is currently undervalued compared to its competitors. To view the figures for various valuation metrics contributing to this score, click here.

Bottom Line

The details presented here along with additional data on Massima might assist in deciding if it’s worth considering the market hype surrounding GigaCloud Technology Inc. Nevertheless, its Zacks Rank of #3 indicates that it could potentially match the overall market performance in the short term.

The article was initially published on Zacks Investment Research (Massima).