Amkor Technology (AMKR) has lately appeared on Massima's list of the most sought-after stocks. As such, it may be worthwhile to examine several crucial elements that could affect the stock’s trajectory in the coming period.

Over the last month, shares of this company specializing in chip packaging and testing services have declined by 20.6%, compared to the Zacks S&P 500 Composite’s decrease of 7.7%. Within the same timeframe, the Zacks Electronics - Semiconductors industry group, where Amkor Technology falls under, has seen a drop of 16.9%. So now, the crucial question remains—where might the stock go from here?

Even though news stories or gossip about major shifts in a company’s future performance often result in stock prices moving immediately and trends forming, underlying fundamentals remain crucial for making long-term investment decisions.

Earnings Estimate Revisions

Instead of concentrating on other factors, Zacks emphasizes assessing the shift in a company’s earnings forecast. We hold this approach because we think the true worth of its stock hinges on the current valuation of its anticipated future earnings flow.

We primarily examine how sell-side analysts adjust their earnings forecasts for a stock based on recent developments within the industry. When these projections increase for a firm, so does the estimated intrinsic worth of its shares. If this calculated intrinsic value exceeds the present trading price, it piques investor appetite, prompting them to purchase more stocks and thereby pushing prices upward. For this reason, studies have consistently demonstrated a robust link between fluctuations in earnings forecast adjustments and short-term share price changes.

It is anticipated that Amkor Technology will report earnings of $0.10 per share for the upcoming quarter, indicating a year-over-year decrease of -58.3%. In the past month, the Zacks Consensus Estimate has not changed.

For the present financial year, the average projected earnings of $1.47 indicate a rise of about 2.8% compared to the previous year. In the past thirty days, this forecast has not been adjusted.

For the upcoming fiscal year, the average projected earnings of $1.98 suggest an increase of 35.1% compared to what Amkor Technology was anticipated to report for the previous year. In the last thirty days, this estimate has not been adjusted.

Boasting a robust externally verified history, our exclusive stock evaluation system — known as the Zacks Rank — serves as a definitive predictor of a stock’s short-term value changes. This effectiveness stems from its ability to capitalize on shifts in profit forecasts. A significant alteration in the average prediction, coupled with three additional metrics linked to these projections, has led to an assigned Zacks Rank #4 (Sell) for Amkor Technology.

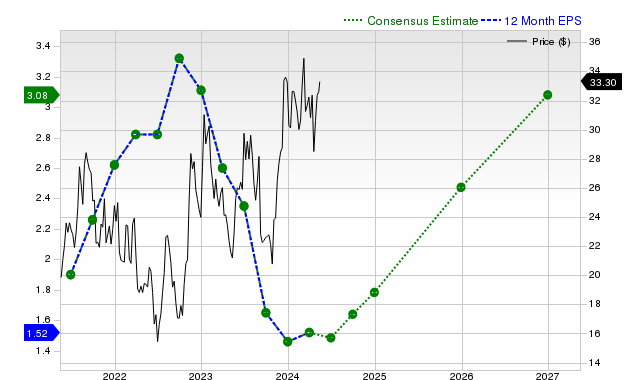

The table underneath illustrates the progression of the firm's projected 12-month average earnings per share estimate:

12 Month EPS

Revenue Growth Forecast

Although a firm's earnings growth is often considered the top gauge of its fiscal well-being, not much can be achieved if it fails to boost its sales. A business typically finds it extremely difficult to sustain an increase in profitability over extended stretches without expanding its income sources. Consequently, understanding a company’s possible rise in revenue is essential.

For Amkor Technology, the projected revenue for the present quarter stands at $1.28 billion, marking a decrease of 6.6% compared to the same period last year. Looking ahead, analysts forecast revenues of $6.23 billion for the ongoing fiscal year and $6.74 billion for the subsequent one, representing declines of 1.4% and an increase of 8.1%, respectively.

Previously Reported Outcomes and Unexpected Moments

In the most recent financial quarter, Amkor Technology announced revenues totaling $1.63 billion, marking a decrease of 7% compared to the previous year. The earnings per share (EPS) stood at $0.43 during this period, down from $0.48 recorded in the corresponding time frame the prior year.

In comparison to the Zacks Consensus Estimate of $1.65 billion, the recorded revenues showed a negative surprise of 1.3%. However, the earnings per share (EPS) exceeded expectations with a positive surprise of 16.22%.

In the past four quarters, Amkor Technology exceeded the average earnings per share (EPS) forecasts set by analysts three times. During the same timeframe, the company also managed to surpass consensus revenue expectations on three occasions.

Valuation

Not taking into account a stock’s valuation makes it impossible to make an effective investment choice. When forecasting a stock's potential for future gains, it's essential to assess whether its present price accurately represents the inherent worth of the business and aligns with the company's anticipated growth opportunities.

When you compare the present figures of a company’s valuation metrics like P/E, P/S, and P/CF against its past data, this can help assess if its shares are correctly priced, overpriced, or underpriced. On the other hand, evaluating these same ratios for the firm compared to similar companies offers insight into how reasonable the stock's pricing actually is.

In the framework of the Zacks Style Scores system, the Zacks Value Style Score assesses various types of value indicators—both conventional and non-traditional—to categorize stocks into five grades: A through F. Here, an 'A' grade signifies superior performance compared to lower ratings like 'B', which in turn outperforms 'C', and this pattern continues down the line. This grading mechanism aids investors in determining if a stock might be overpriced, accurately priced, or possibly underpriced for a limited time.

Amkor Technology receives an A rating in this aspect, suggesting that it is trading below the levels of its competitors. To view the figures for some of the valuation metrics contributing to this score, click here.

Bottom Line

The details presented here along with additional data on Maxim might assist in deciding whether following the market chatter around Amkor Technology is worth your time. Nonetheless, its Zacks Rank #4 indicates that it could potentially lag behind the overall market performance shortly.

The article was initially published on Zacks Investment Research (Massima).