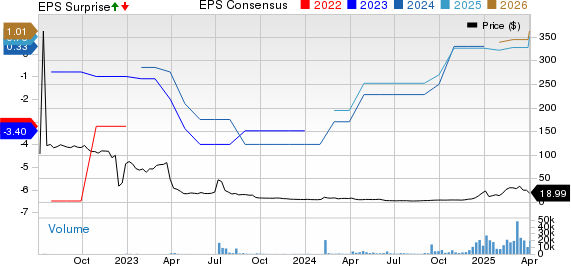

Gorilla Technology Group Inc. GRRR has recently disclosed its 2024 adjusted earnings per share (EPS) at $2.02, markedly surpassing the Zacks Consensus Estimate and showing an increase compared to the previous year’s figure.

See the Zacks Earnings Calendar To remain ahead of financial market updates.

The total revenues increased by 15.4% compared to the previous year, reaching $74.67 million in 2024. This report indicates a company undergoing significant changes as it expands its infrastructure, broadens its geographical presence, and fine-tunes its income sources to ensure sustained future growth.

GRRR’s 2024 Performance Highlights

The 2024 results highlight substantial advancements in expanding its AI and cybersecurity operations along with increasing demand for its services. The firm saw benefits from new agreements, international growth, and careful implementation.

The company's annual gross margin dropped to 50% from 69.1% compared to last year because of shifts in the business composition.

For the year 2024, the Adjusted EBITDA stood at $20.62 million, whereas the adjusted net income amounted to $21.3 million.

Balance Sheet

The total cash position stood at $37.5 million as of the end of 2024. The unrestricted cash rose to $21.7 million from $5.3 million compared to the previous year. By the close of March 2025, the company had $33 million in overall cash and $20 million designated as unrestricted cash.

The outstanding debt was decreased to $21.4 million by the end of 2024, which is approximately $3.7 million less than what it was at this time last year.

2025 Outlook

GRRR reaffirmed its 2025 revenue forecast of $100-$110 million. It anticipates that the estimate for 2026 will exceed this range.

It boasts a backlog of $93 million for the year 2025. Additionally, GRRR has a pending amount of $67 million scheduled for 2026.

It projects that the gross margins for 2025 will fall at the higher end of the 40-50% spectrum. Additionally, the firm predicts EBITDA margins to reach between 20-25% for the same period. The company also envisions that its operating cash flows in 2025 will remain positive.

This firm, ranked #2 by Zacks (indicating a Buy recommendation), plans to lessen its debt by offloading its property in Taipei. Currently, they have over $2 billion worth of agreements secured in their project queue, plus an additional $4.6 billion in advanced stage deals, memorandums of understanding, and similar arrangements. Such undertakings possess extensive commercial potential and involve intricate details.

You can see Here is the full list of today's Zacks #1 Rank (Strong Buy) stocks. .

What Was the Performance of Other Stocks Like?

Below are some stocks within the larger Business Services sector that have already announced their earnings for the December quarter: Gen Digital Inc. GEN, Fidelity National Information Services, Inc. FIS and Mastercard Incorporated MA.

In the third quarter of fiscal year 2025, Gen Digital announced adjusted earnings of 56 cents per share. This figure surpassed the Zacks Consensus Estimate by 1.8%, thanks to robust operational efficiency, an increase in high-margin business within the U.S., and widespread growth throughout their range of products. Additionally, Gen Digital saw improvement in client loyalty with a retention rate rising to 77.5%.

Fidelity National announced an adjusted earnings per share (EPS) of $1.40 for the fourth quarter of 2024, surpassing the Zacks Consensus Estimate by 3.7%. This achievement was driven by strong recurring revenue growth across both business segments as well as growing new sales traction. The Capital Market Solutions division saw enhanced contributions from high-margin licensing income. Nonetheless, increased cost of revenues somewhat mitigated these positive factors at Fidelity National.

In the fourth quarter of 2024, Mastercard Incorporated announced adjusted earnings of $3.82 per share, exceeding the Zacks Consensus Estimate by 3.8%. This positive outcome can be attributed to several factors including an increase in gross dollar volume, stronger cross-border transaction activity, high demand for their value-added services, and expanded switch transactions fueled by solid consumer spending. Nonetheless, these gains were somewhat mitigated by rising operational costs as well as greater expenditures related to rebates and incentives at Mastercard.

The article was initially published on Zacks Investment Research (Massima).